BFJ – TTS Daily Updates 29102020

BFJ Research

04.11.2020

Part 1. Market Overview

Yesterday’s market ended with fall in USD, whilst investors were anticipating a Biden victory in the US election as he was ahead of Trump in the polls. Although there is an expectation that Biden will win and the Democrats regain control of the Senate, nobody is entirely sure what will happen over then next 24 hours. The RBA yesterday announced cuts to interest rates and a step up in bond buying, whilst other major banks such as BoE and Fed are expected to follow, RBA’s decision will not have significance influence in the strength of the AUD.

Part 2. Previous Economic Data Highlight

![]()

RBA yesterday’s announcement on rates cut to 0.1% was on par with forecast and expectation, which was seen as a necessary move along with more QE, in which the RBA steps up in bond buying, with the plan of $100bn over the 5-6 years period. Importantly, Governor Lowe also said he will closely monitor what the global peers are doing and decide whether it is necessary to go into negative rates territory.

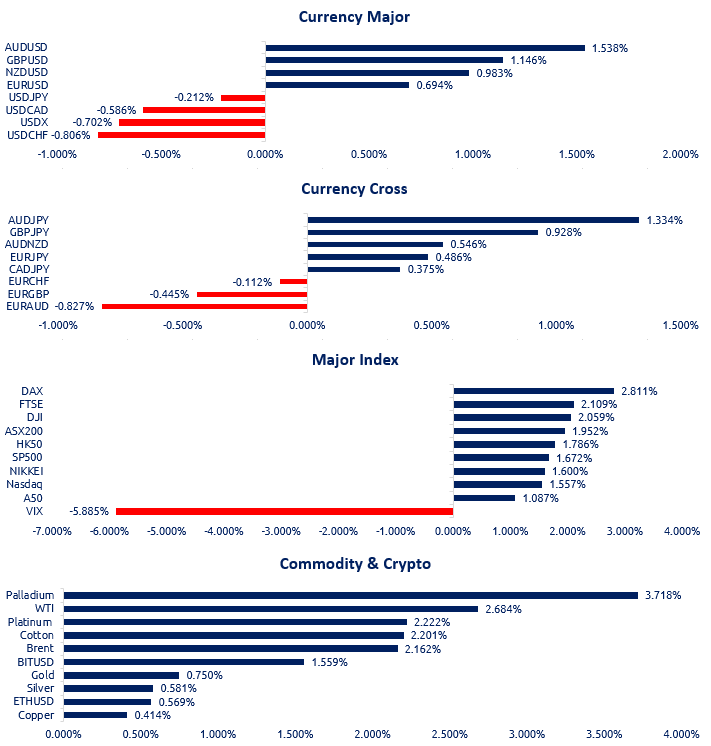

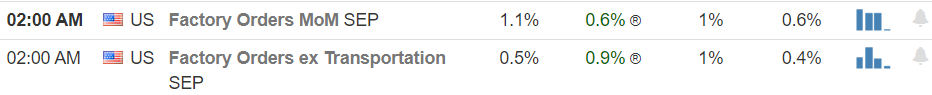

US September factory order was better than previous month and forecast, demand rebounded for transport equipment, and electronic products continued to rise but at a slower pace.

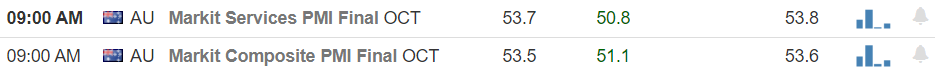

Australian October PMI has little changed from the forecast.

Part 3. Upcoming Economic Data

China’s Caixin PMI is forecasted to be 6 straight months of growth. New orders expanded faster, mainly led by domestic demand, whilst employment grew for second month in a row, both of which as strong sign of economic recovery.

Part 4. Technical Analysis

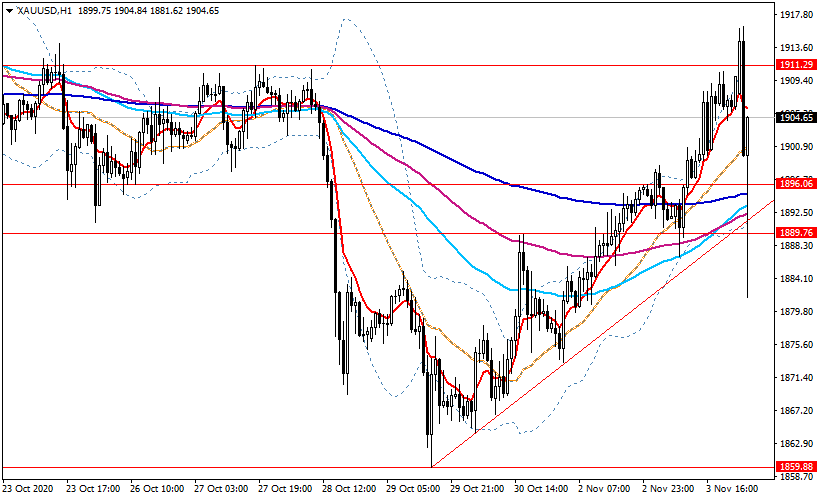

XAUUSD

Today’s market is expected to be heavily fluctuated due to US election.

中文 (中国)

中文 (中国) English (Australia)

English (Australia)