TTS Daily Updates 12112020

BFJ Research

12.11.2020

Part 1. Market Overview

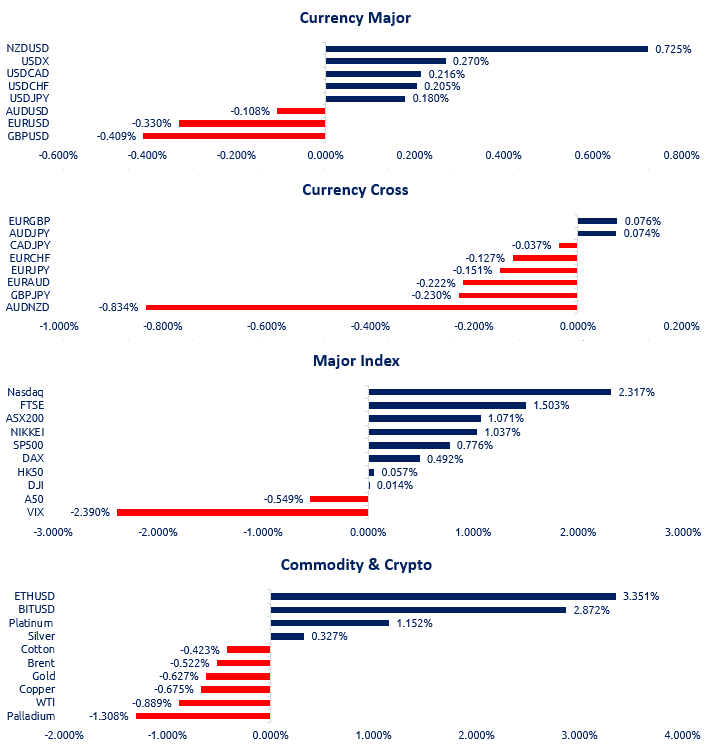

Yesterday’s market continued to respond positively to the hope of a vaccine, equity market finished quite strong with rebound in tech stocks led by firms such as Apple, yet the sentiment was more tamed in the currency market. Central bankers seem to be taking a more cautious tone, while the tone set by the ECB’s Christine Lagarde was one of concern at their conference yesterday. The RBNZ continued to present a dovish outlook, despite NZ’s low infection rate; however, the expectation of negative interest rates has diminished significantly. Although the progress in Covid vaccine development has found tremendous success, the virus is still raging, with new cases in the US yesterday reaching close to 140,000, and the UK reached 50,000 fatalities today.

Part 2. Previous Economic Data Highlight

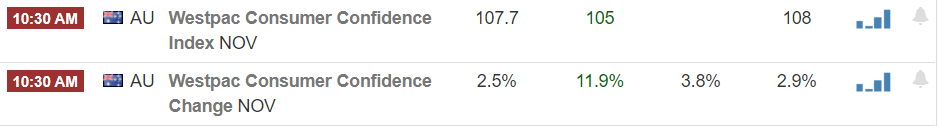

Westpac’s November consumer confidence marked the fourth consecutive increasing positive month, with promising outlook to an economic recovery.

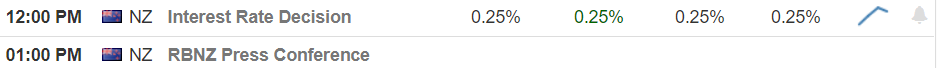

Despite previously hinted negative rates, the RBNZ decided to keep the interest rate unchanged at 0.25% yesterday. Yet, the Monetary Policy Committee agreed to provide additional monetary stimulus to the economy in order to meet its consumer price inflation and employment remit.

![]()

Lagarde yesterday warned against vaccine optimism and hints at more ECB easing, yet nothing was significant enough to move the market.

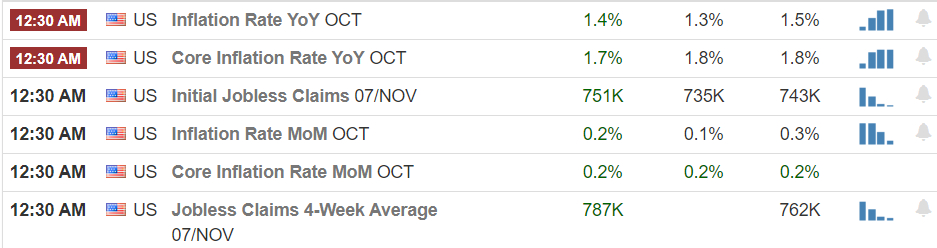

Part 3. Upcoming Economic Data

US October inflation rate will be released tomorrow and it is forecasted to have a slight improvement than previous month, if actual data is consistent with forecast, then it will be the fifth consecutive month of increase, despite it is still lower than last year, it shows progress of an economic recovery in the right direction. Looking at previous month, the increase of the inflation rate was led by an increase in vehicle prices, but a decrease in food and shelter, this could indicate the adaption towards Covid lifestyle, however with Covid continue to rage in the US, the sustainability of the spending pattern is questionable. In terms of jobless claims, it is expected to be the fifth consecutive week of decrease, yet it will still be well above pre-pandemic levels.

Part 4. Technical Analysis

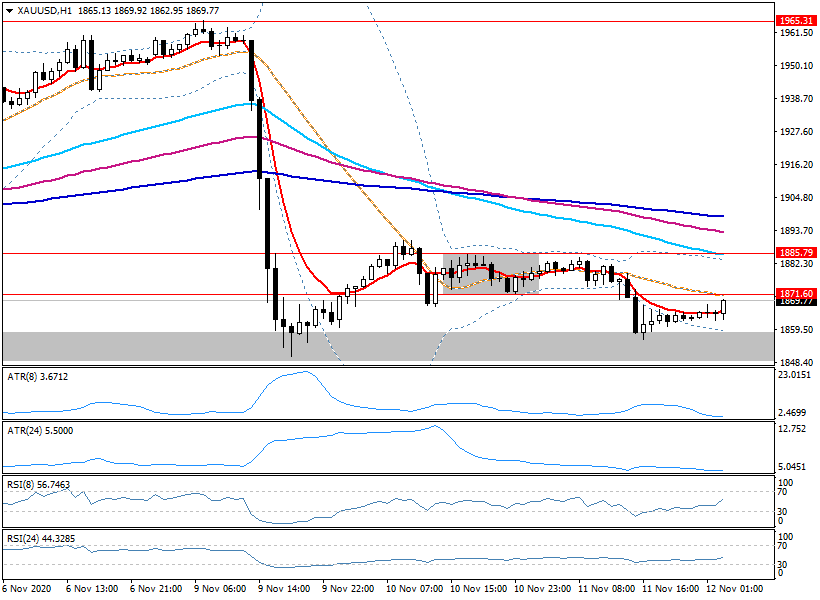

XAUUSD

XAU yesterday broke out the tight range consolidation and tested the support at 1855, this support area was tested numerous times on the daily chart for the past three weeks and was proven quite effective. In terms of intraday, the is still no clear direction, while our 5MA system continues to be bearish on the hourly chart, a upward trend maybe difficult to initiate without support from the fundamental level; with low ATR showing low volatility and RSI being quite stable, investors are recommended to do range trading. If the candlestick breaks resistance at 1871, then the next resistance at 1885.5 should be watched closely; if the candlesticks breaks support at 1856, then the grey support area should be closely examined.

中文 (中国)

中文 (中国) English (Australia)

English (Australia)