2020 US Presidential Election: Biden vs Trump

Section 1. Political Agendas

In the 2020 US Presidential Election, both Joe Biden and Donald Trump, representing the Democratic and Republican parties respectively, both carry very different political agendas. Below is a table of summaries of eight major aspects in their political campaigns.

| Biden | Trump | |

| Personal Tax | • Increase tax for high income (>$400k) to 39.6% from 37%.

• Tax long-term capital gains and qualified dividends • Cap itemized tax deduction for high earners • Expand several tax credits including renewable energy tax for individuals

|

• Extend the reduction of individual income tax (max 37%)

• Reduce payroll taxes • Reduce capital gains tax rate

|

| Corporate Tax | • Increase corporate income tax rate from 21% to 28%

• Impose minimum 15% tax on US based corporations with book profit >$100m • Increase tax for foreign subsidiaries of US firms from 10.5% to 21% • Expand tax credit for investments in minorities

|

• Extend the reduction of corporate income tax to 21%

• Offer ‘Made in America’ tax credits to companies bringing jobs back to the US • Introduce 100% expensing for essential industries that bring jobs back to the US

|

| Trade | • Increase federal spending on goods made by US workers by $400bn

• Take enforcement actions against China and rally US allies to pressure China and other trade abusers |

• Previously imposed tariffs on Chinese imports

• Enact fair trade deals that protect American jobs

|

| Labor | • Raise federal minimum wage to $15/hr

• Ban state-level ‘right to work’ laws (The right-to-work law gives workers the choice of whether to join a union) |

• Bring back manufacturing jobs from China

|

| Immigration | • Establish a roadmap to citizenship for unauthorised migrants currently in the US

• End the practices of keeping immigrants in long-term detention

|

• Block illegal immigrants from becoming eligible for taxpayer funded benefits

• Establish mandatory deportation of non-citizen gang members • Prohibit American companies from replacing US citizens with lower cost foreign workers |

| Healthcare | • Provide purchasing opportunity for public health insurance options like Medicare

• Lower Medicare eligibility age from 65 to 60

|

• Previously ended Affordable Care Act

• Reduce prescription drug price • Lower healthcare premiums • End surprising billing • Cover all pre-existing conditions • Protect veterans |

| Education | • Provide grants to states that want to eliminate tuition at public colleagues

• Free tuition at all community colleges • Universal pre-kindergarten • Increase K-12 education funding for low-income schools |

• Provide school choice to every child in America

|

| Justice / Policing | • Promote community-oriented policing

• Address misconduct in police departments and prosecutors’ offices • End mandatory minimum |

• Fully fund and hire more police officers

• Increase criminal penalties for assaults on police officers • End cashless bail and keep criminals locked up pre-trial |

The biggest policy conflict between Biden and Trump is around taxation, under Trump’s administration, corporates and banks will thrive, and therefore boosting the overall US economy; conversely, Biden believes the working class is the foundation to the US economy, and therefore by closing the gap between the wealthy and the poor, the economy as a whole will improve. Similar concept is carried on in healthcare, which is another major conflict, Trump believes by improving the overall economy, Americans will be wealthier, in conjunction with lowered drug price, affordability will increase and thereby cutting expenditure in healthcare is sustainable; on the contrary, Biden urges to roll out Medicare to improve accessibility rather than affordability.

If Biden win US election, an increase in government spending is expected, along with a larger stimulus package. To fund these plans, a release of treasury bond is highly likely. If Trump wins election, it will favor corporations, and an increase in US equities is expected.

Section 2. Election Polling

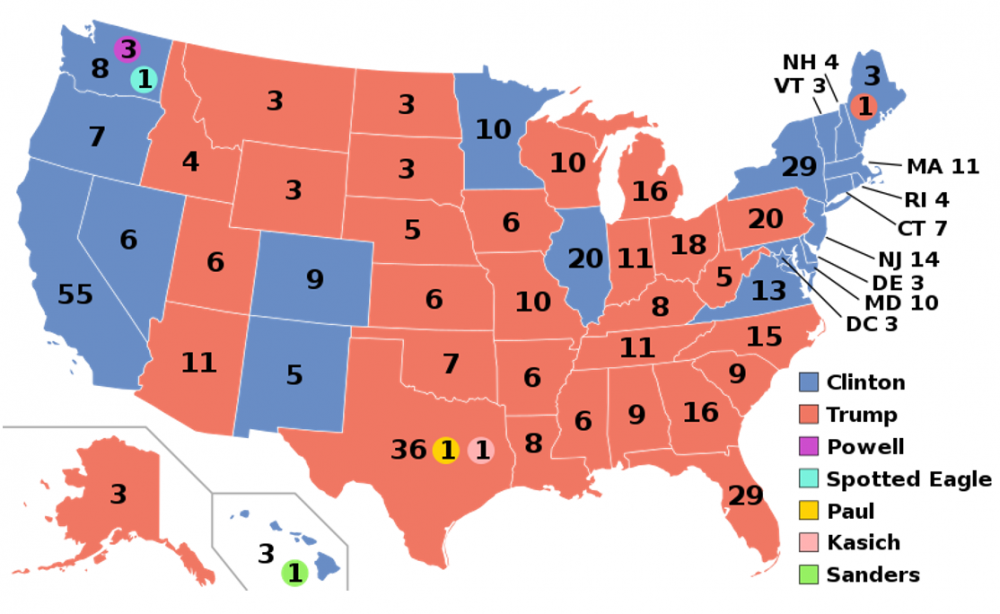

To understand polling and how the market is reacting to it, it is important to understand the fundamental of US election mechanism first. When Americans are voting in the US, what they are actually voting for is their local state electoral colleges. There are 538 colleges in the US spread across the nation, California has the most amount of colleges counting at 55, followed by 38 in taxes, 29 in Florida and New York. In states with less dense population, colleges could be fewer accordingly. Every college count as one vote for the presidential election, where a presidential victory requires 270 votes from colleges. For instance, if the Democrats win by 50.1% in California, then Biden will get all 55 votes from the states. This unique mechanism allows opportunity in surprises, where the electoral votes may be unmatched with crowd favors, and the closest election surprises happened in 2016 and 2020. In 2016, Donald Trump had 300 million less votes from the crowd than Hilary Clinton, however he had more votes from the colleges (see Appendix 1 for 2016 electoral votes). In 2000, George W Bush won the election with 271 electoral college votes, yet Al Gore had half a million more votes than Bush from the crowds. Therefore, even though Joe Biden is the crowd favorite now, investors should not undermine Trump’s odds completely, moreover, there are concerns regarding polling certainties, which will be discussed next.

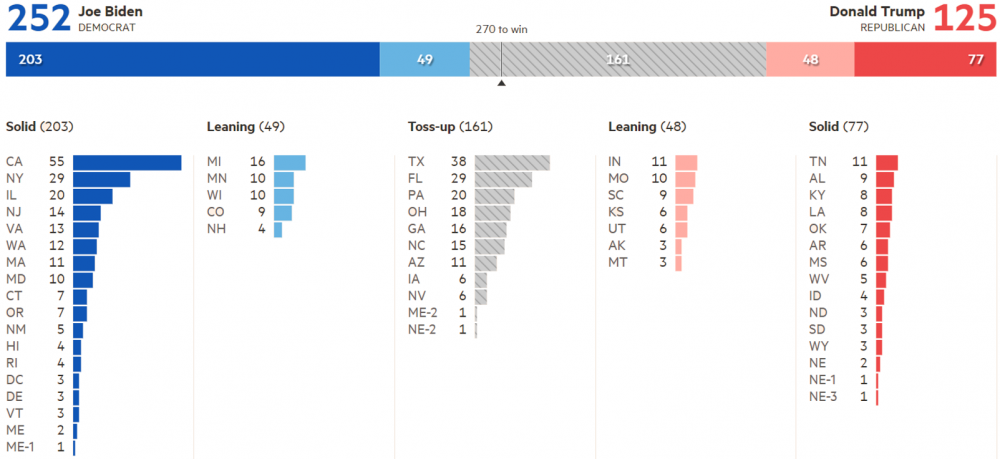

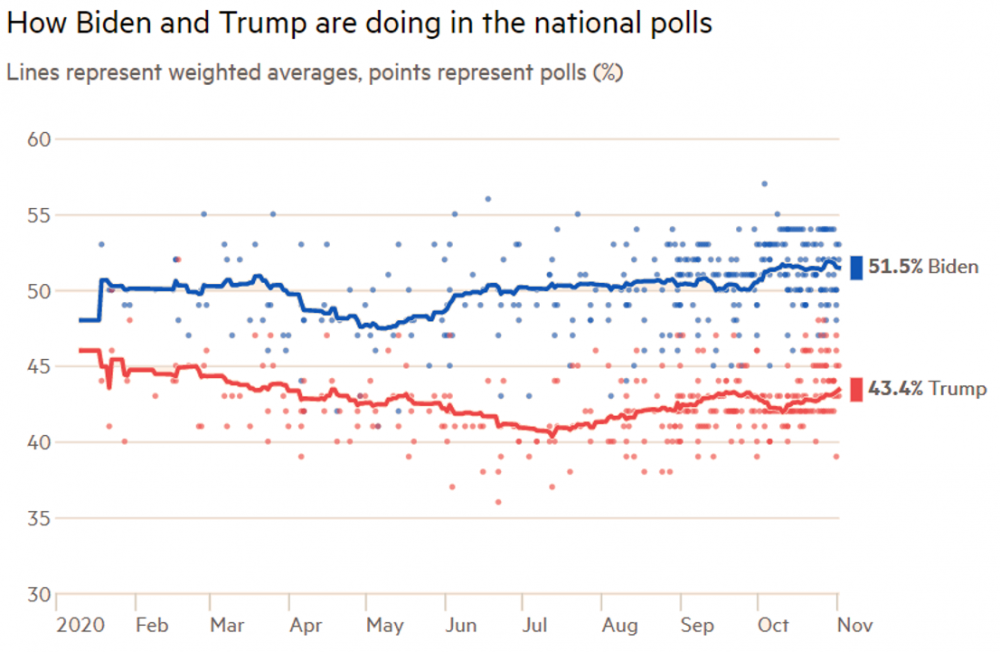

According to RealClearPolitics, as of today 2nd Nov 2020, Biden has a 8.1% lead in the US national polls (see Appendix 2)1, and according to Financial Times simulation, if the election were held today, the latest polls suggest a Joe Biden favored outcome in the electoral college (see Figure 1)2. As the days approach the finale, more and more states have transformed into swing states, this include Taxes which historically had been a loyal Republican supporter. Despite Joe Biden’s seemingly significant lead, investors should be aware of the construction in the current polling. Firstly, the current polling simulation takes in consideration of early mail voting, which are largely Democratic favored, as Biden encourages early voting whilst Trump has spent extensive effort to not only discourage early voting, but also attempted to exclude early votes via suiting in court. Similarly, Trump encourages voters to vote in-person on the election day, therefore investors can also expect a surge in Republican voters on election day. As early mail voting is a recurring theme in this unprecedented election, there may be delay in vote counting, whilst some states may release their counting results earlier due to time zone difference, and it will be discussed later in section 3.

Figure 1: Latest simulation of election result based on current electoral colleges

Section 3. The Focal Points

As the amount of swing states increased gradually as the time approaches election date, some swing states play critical roles in determining an election victory. While Covid-19 continues to be the recurring theme of 2020, some swing states’ Covid cases are soaring, these include swing states that have high electoral vote potentials. Wisconsin for instance, has 10 electoral votes, whilst the state averages 70,000 new cases per day, Biden has a 17% lead over Trump, as Trump was heavily criticized for his Covid responses. Similar notion is portrayed in Michigan and Iowa, with 16 and 6 electoral votes respectively, both have high Covid positivity rates3. As Trump won by 9% in 2016 at Iowa, the fact that Biden has a 4% lead now demonstrates the impact of Covid-19 towards the 2020 US presidential election.

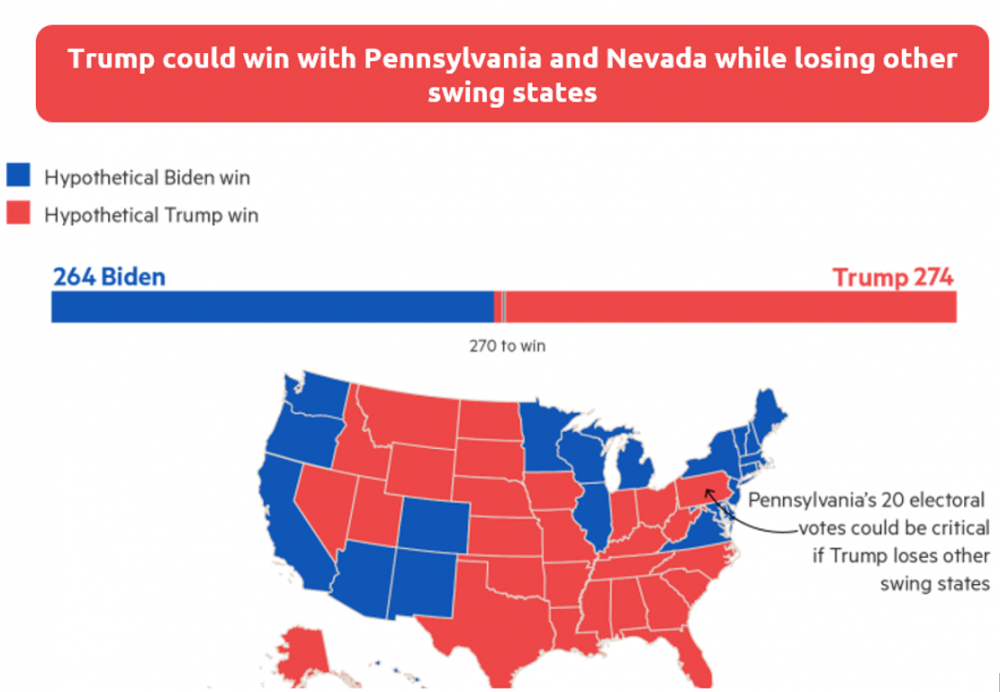

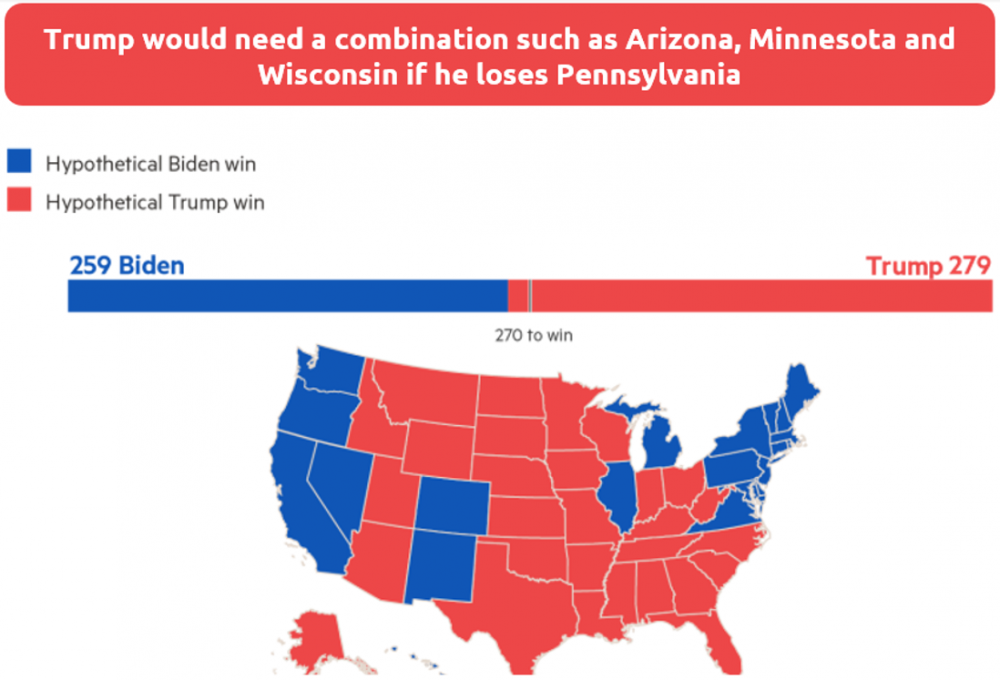

The presidential candidates have both clearly realized the importance in winning the swing states, where Joe Biden continues in-person campaigning until yesterday, and Donald Trump held three rallies in Pennsylvania on 26th Oct, showing sign of significance to his re-election chance. Pennsylvania historically played a crucial role in Trump’s 2016 victory, it was the state’s first-time supporting Republican since George HW Bush in 1998, however Biden currently has a 5.7% lead over Trump in Pennsylvania4. Below are to simulated scenarios of Trump victory, demonstrating the importance of Pennsylvania towards Trump’s success.

Figure 2: Trump victory with scenario of Trump winning Pennsylvania

Figure 3: Trump victory with scenario of Trump not winning Pennsylvania

Beside Pennsylvania, there are two more states who play critical roles on the election night, where the night could hinge on moments when markets conclude who has won, rather than media networks call a winner. As mentioned in previous section, the challenge is to understand how the news flow on election night, which might be tricky this year due to early mailing ballot. The record shattering growth of vote by mail is likely to distort the counting of voting that we are accustomed to. For investors, how the market concluded is more import than what the medias call eventually. The road to knowing the election result on the night is likely to go through Florida and North Carolina, with 29 and 15 electoral votes respectively, where 65% of Florida’s mailed in ballot had been returned, and so is 56% of North Carolina. Both states can start counting those votes and publicly release upon poll closing, and both states can return quick results, and this opens the possibility of knowing the election result early in the night. The implication follows the rigorous logic below: Trump is likely to need to win Florida as he is currently behind (if the currently polling is accurate), if he appears to lose, then he is probably going to lose the presidency; similarly, if the North Carolina race is won by Democrats, then it is probably the indication that Democrats had taken control of the Senates by also winning seats in other close races. Media networks could lag due to the need to count outstanding electoral votes from swing states such as Michigan and Pennsylvania. If, however, Trump wins Florida and North Carolina, then the outcome may depend on the slower counting states.

Section 4. Historic Market Movements

Trump’s 2016 victory impacted the FICC market significantly as the market priced in Clinton victory prior to Trump’s election. Below are two graphical comparisons of FICC products on election week (6th Nov 2016) and post-election week (13th Nov 2016). 5

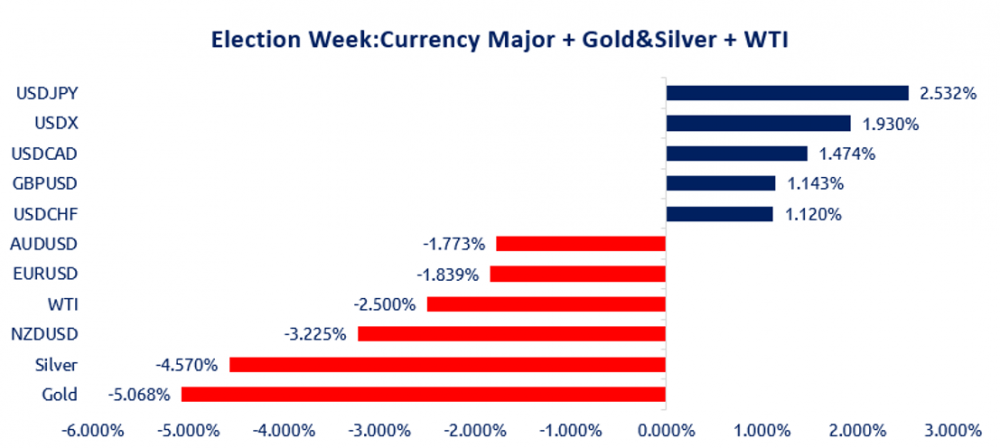

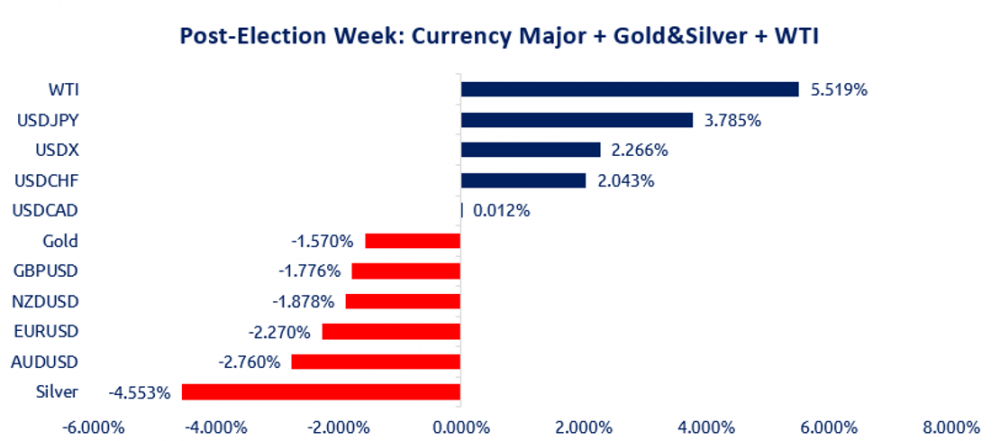

Figure 4: FICC product movements on 2016 US election week

Figure 5: FICC product movements on 2016 post-election week

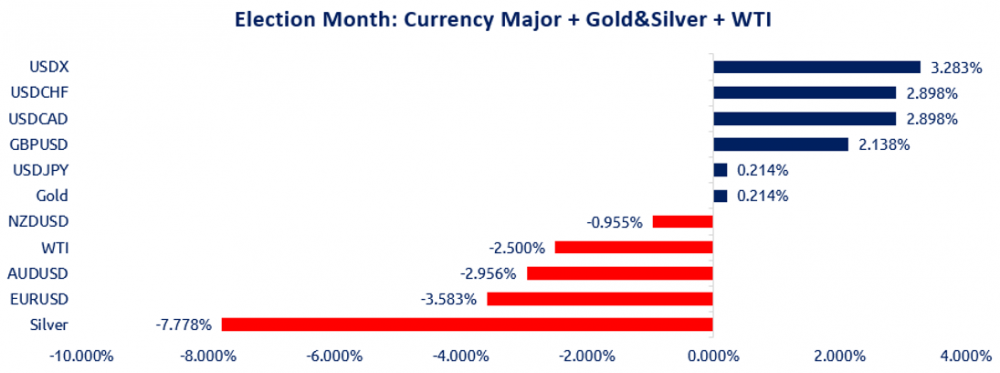

Trump’s victory boosted the value of USD by 1.93% in the first week and 2.266% in the second week, whilst Gold was down by -5.068% in the first week along with other commodities, and down by -1.57% in the second week. The rise of USD was caused by the market perception towards a potential boost in the US economy. Since the Obama administration only delivered good news in GDP growth 6 quarters out of 31, Trump had a series of promising plans to boost the economy, including deduction of corporate and personal tax, cutting cost on migrants, and American First tough trading strategies. Over the month, the market has done little correction in the FICC market, with USD continued to rise, and silver decreased further.

Figure 6: FICC product movements during 2016 election month

Appendix

Appendix 1: 2016 US Presidential electoral votes 6

Appendix 2: Latest electoral polling (2nd Nov 2020)

Reference

- RealClearPolitics – Live Opinion, News, Analysis, Video and Polls. (2020). Retrieved 3 November 2020, from https://www.realclearpolitics.com/

- Biden vs Trump: US presidential election poll tracker. (2020). Retrieved 3 November 2020, from https://ig.ft.com/us-election-2020/

- Donald Trump’s path to victory narrows as Covid cases surge in Midwest. (2020). Retrieved 3 November 2020, from https://www.ft.com/content/31e081ae-03fc-453c-b8b5-3536be927bc8

- Donald Trump’s path to victory runs through Pennsylvania. (2020). Retrieved 3 November 2020, from https://www.ft.com/content/b592d770-86c9-469f-a174-ce180056c24e

- Historical prices were extracted from MT4, Vantage.

- (2020). Retrieved 3 November 2020, from https://en.wikipedia.org/wiki/File:ElectoralCollege2016.svg

English (Australia)

English (Australia) 中文 (中国)

中文 (中国)

Recent Comments