TTS Daily Updates 16112020

BFJ Research

16.11.2020

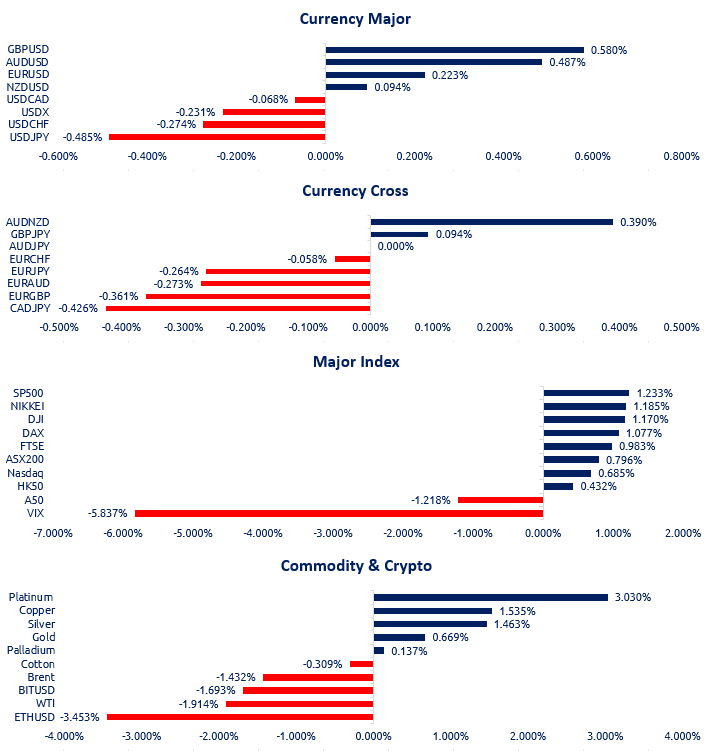

Part 1. Market Overview

Last week was a volatile week, markets enthusiasm stemming from the hope of a vaccine led the charge, with some shifting of focus on equity market. The infection numbers continued to rise, particularly in the US where the daily new cases surpassed 125,000 today, the President has flatly stated there will be no lockdowns so long as he is in charge. The push-pull effect of vaccine news versus Covid data will likely to drive the markets again this week, with the added diversion of Brexit as the UK’s Chief advisor of Brexit negotiation Dominic Cummings resigned on Friday, this could potentially lead to Johnson taking a more conciliatory approach and a deal could be forthcoming.

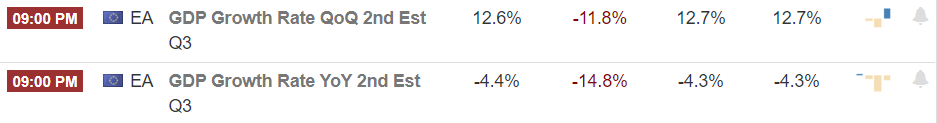

Part 2. Previous Economic Data Highlight

The Eurozone economy GDP growth was positive in Q3, recovering from a record slump of 11.8% in the previous period. The boost was contributed by a rebound in activity and demand as lockdowns imposed to contain the spread of the coronavirus was gradually lifted.

Part 3. Upcoming Economic Data

Both RBA and BoE are due to speak this week, while the RBA is usually quite forthcoming, they may provide some guidance on the economic outlook, but impact may be minimal as Lowe previously set the tone quite firmly; BoE on the other hand may provide more intriguing comment, as the resignation of Dominic Cummings may lead to a sped up Brexit deal.

Part 4. Technical Analysis

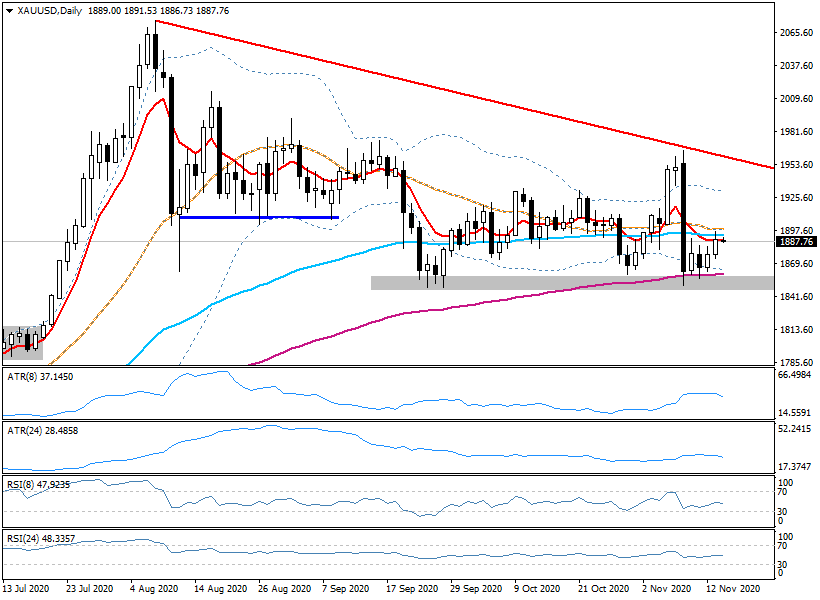

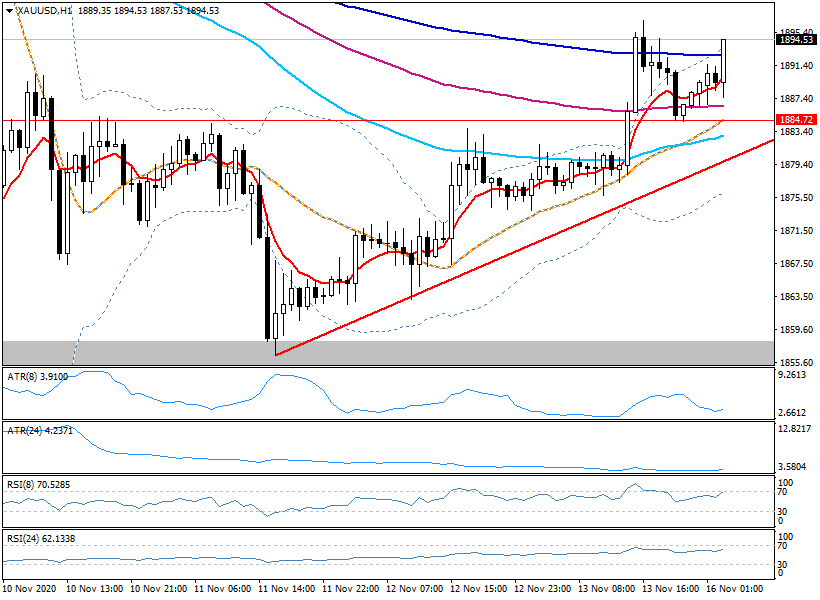

XAUUSD

Fundamentally, there weren’t many news that would move the gold price, whilst Trump did threaten to take legal action against the US Election, the progress has been minimal; on the other hand, the optimism brought by the Covid vaccine has tamed, as there were other concerns remained unsolved, such as logistics and distribution, more importantly, the vaccine only touched on immunity, but it didn’t tackle the issue of transmission, meaning there could be more asymptomatic spreading the virus. These extra concerns have stalled the gold market after last Monday’s vaccine news, and it is searching for direction now. Yet, the US 10-year treasury bond yield continued to rise slowly, which could be a positive news for the gold market.

On the technical aspect, XAU remains in the triangular consolidation on the daily chart as the support at 1850 area is proven effective. In terms of intraday, an uptrend has been initiated since last Thursday, yet the momentum is weak as presented by the short-body candlesticks, displaying market uncertainties. The 24hr MA has crossed the 72hr MA from beneath this morning, which is a positive sign for the continuation of this uptrend, along with low ATR and smooth RSI on the hourly chart. If the uptrend does continue, it is recommended to monitor the resistance at 1912 and 1917; if the uptrend falls, then the effective of the support at 1850 area should be once again examined.

English (Australia)

English (Australia) 中文 (中国)

中文 (中国)