BFJ - TTS Daily Updates 27102020

BFJ Research

27.10.2020

Part 1. Market Overview

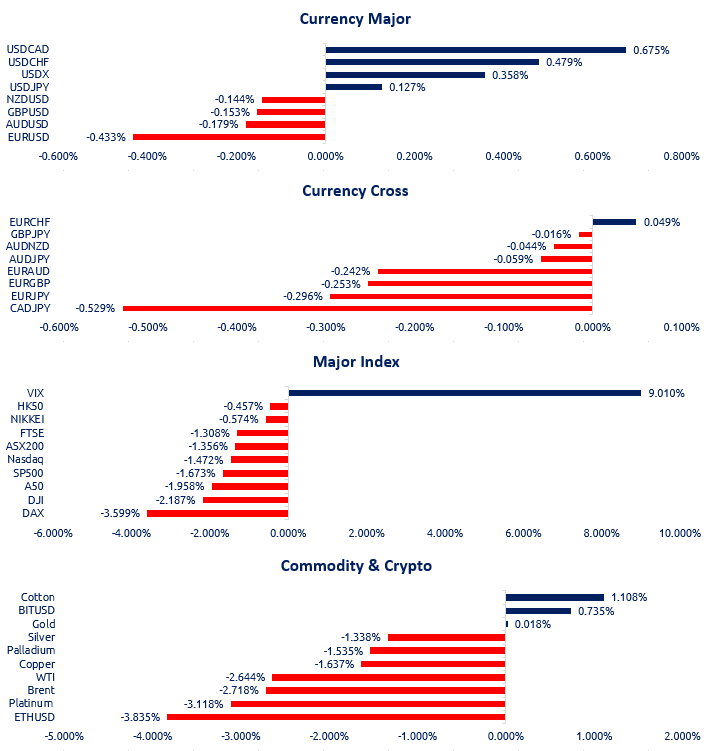

Yesterday’s market continued its search for direction in the sea of uncertainties, the main focal points were on the US and EU, along with news regarding COVID which deters market sentiment. With the US election just days away, Biden currently has a lead over Trump in the polls, USD and US bond prices were up, both suggesting a relative risk-off sentiment. In a statement Biden made yesterday regarding the stimulus, he said a stimulus package will be adopted immediately after his victory, nonetheless the immediacy is questionable as Biden will need to go though the usual process of passing the Senates, not to mention that his victory is yet to be assured. A breaking news in the tech industry blew out yesterday as SAP decreased its forecast, in the COVID era where most tech companies had unparallel stella performance, giants such as SAP’s underperformance to a degree play a roll in undermining the investor confidence.

On the other end, the EUR went down yesterday, the main driver was the geopolitical tension between France and Turkey, resulting in Turkey boycotting French products, which is not beneficial in times of COVID and economic recovery. Speaking of COVID, figures continue to rise in both the US and EU, areas such as Taxes and California all broke record high, which further jeopardize Trump’s hope in winning the election. In Australia, lockdowns in Victoria are lifted, but new COVID cases continue to be reported. The good news is COVID drug maker AstraZeneca reported positive result in vaccine trial, depicting progress in overall safe vaccine development.

Part 2. Previous Economic Data Highlight

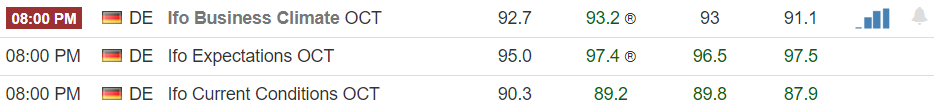

Whilst Germany is portrayed as forefront of European economic recovery, the Ifo data was lower than previous release despite being higher than forecast, companies were considerably more skeptical regarding developments over the coming months following the imposition of tougher restriction measures to curb the spread of COVID.

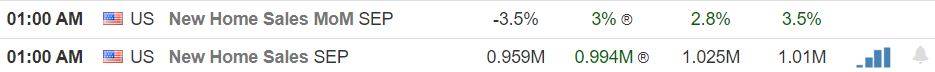

The level of home sales was elevated in the previous months as the housing market has been supported by record low interest rates and increasing demand from people moving away from big cities due to COVID. However, with people’s saving down along with lack of stimulus package, the elevated trend has slowed.

Part 3. Upcoming Economic Data

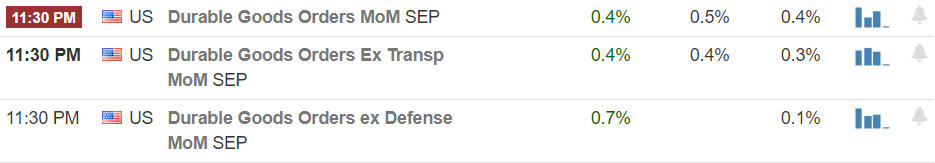

Durable goods orders to an extent reflects the US economic recovery, despite the previous months were positive, they have been decreasing for four consecutive months, with COVID cases continue to rise in the US, such trend is expected to continue.

![]()

It is expected that Bullock will be asked questions regarding interest rates and RBA’s response to CPI as we discussed yesterday, but her guidance may be limited given her role as Assistant Governor. Yet we still need to keep a close eye on the relevant information provided.’

Australian inflation rate will be released tomorrow morning.

Part 4. Technical Analysis

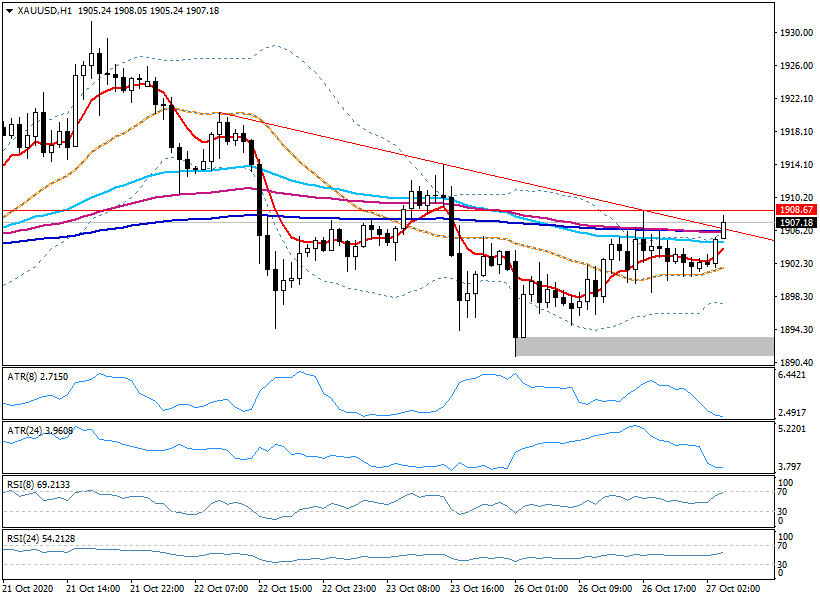

XAUUSD

Along with uncertainties before the US election, the short-term downward movements in the gold market seems to be coming to an end. Yesterday XAU was forming a triangular consolidation in the hourly chart, and the 240hr MA resistance was constantly contested, reaching a high of 1908.67. In terms of intraday, we need to pay close attention in the next two hours to determine whether the triangular consolidation persist and breaking previous high at 1908.67, if so, there may be room for upward movements.

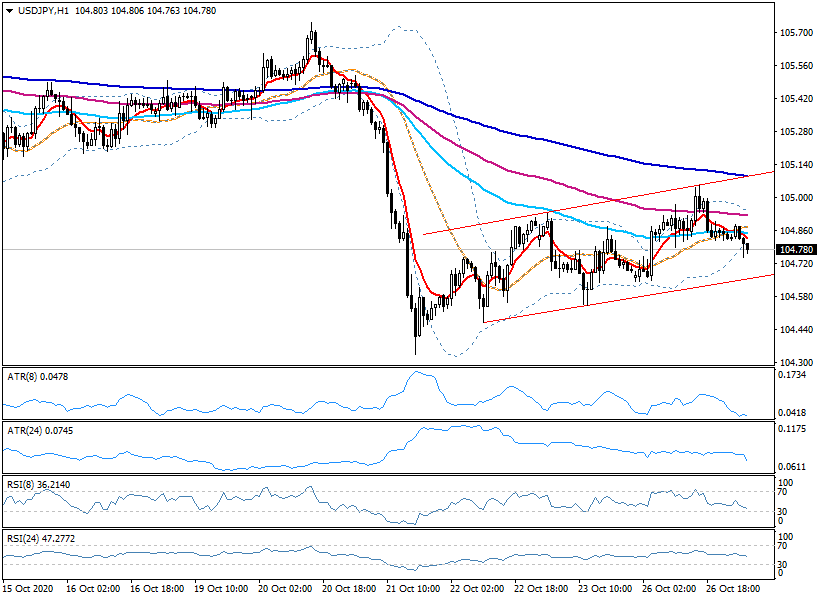

USDJPY

As USD continues to rise, an upward channel has been formed for USDJPY, with higher highs and lower lows. In terms of intraday, the previous low was at 104.65, if we use this as support and it is effective, then the upward channel could be continued. This is also supported by 24hr MA cross 72 MA from beneath and smooth 24hr ATR.

English (Australia)

English (Australia) 中文 (中国)

中文 (中国)