BFJ – TTS Daily Updates 28102020

BFJ Research

28.10.2020

Part 1. Market Overview

With US election only 7 days away, the market is fairly calm, investors are now closely monitoring the poll, with Biden leading Trump by 8.6% according to RealClearPolitics, despite there is an increase in Trump support according to survey done by FT, especially in states that were the foundation to Trump’s 2016 victory, more than 60 million Americans have casted their ballots, leaving questions regarding the significance of increase in Trump support. According to news from Euronews, significant number of supporters would take to the streets if their preferred candidate didn’t win, and potential violent acts may occur. Despite Pelosi insisting her optimism in the stimulus package, the progress has been stalled, and agreeing upon the deal seems increasingly unlikely before the election.

Through rising COVID numbers into the mix, the market continues to struggle to find certainty right now. With US COVID deaths rise to summer outbreak level, as well as Imperial College London’s research showing immunity could fade even after successful healing from COVID. In Australia Melbourne relaxes strict rules from Wednesday, but cross-state boarders are remained closed, yet this will still boost local economic activity.

Part 2. Previous Economic Data Highlight

![]()

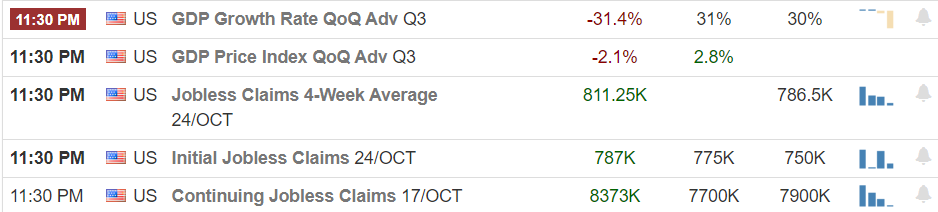

The Chinese industrial profits have been rising for eight consecutive months now, although the YoY data is still negative, but it still demonstrates positive progress in recovery of the Chinese economy. Considering China was the first economy to recover to pre-pandemic GDP, this data is within the range of expectation.

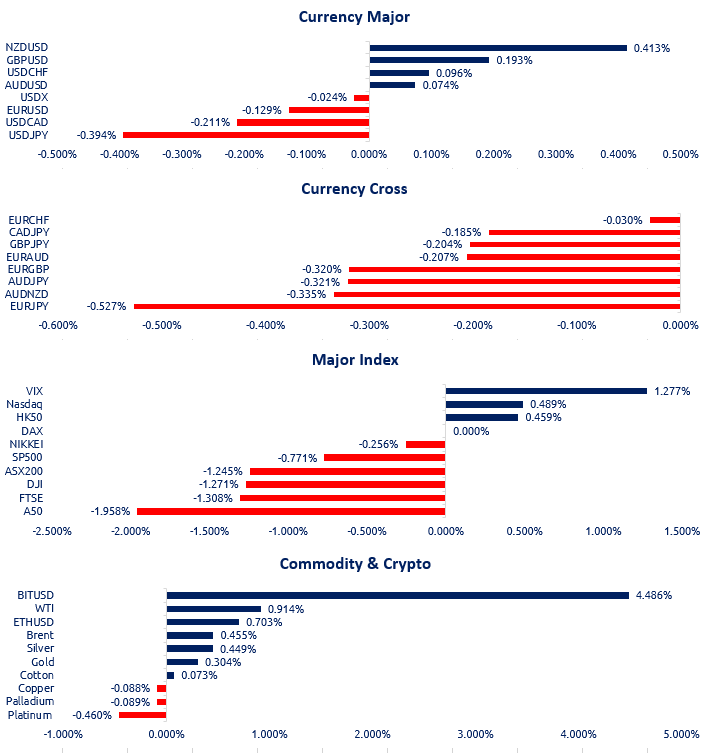

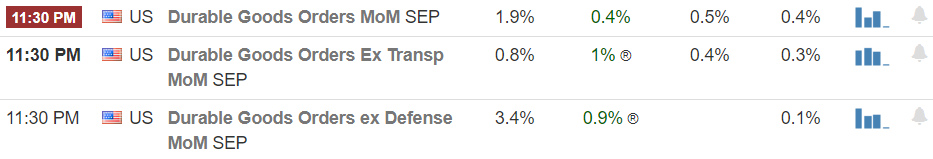

September US durable goods orders data beats both previous month and forecast, a rebound in transportation equipment, motor vehicles and metal products, which are all fundamental industrial goods, foreshadows a positive recovery.

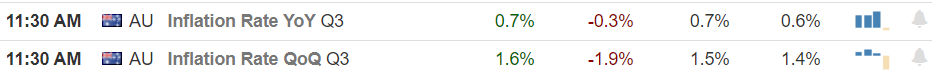

Australian Q3 CPI was close to forecast, however under unprecedented times today with uncertainties from the global market and COVID, the importance of CPI data is undermined.

Part 3. Upcoming Economic Data

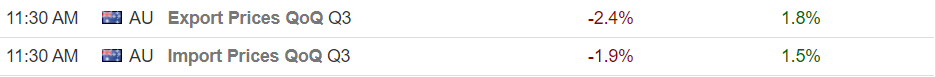

Australian import and export data will be released tomorrow.

The US GDP growth rate and jobless claims numbers will also be relased tomorrow. The former has a forecast of QoQ 30% increase, which is very optimistic considering the US economy is negatively impacted by the increasing COVID cases. The latter forecast is lower than previous release, most the drop can be attributed to California, where the claims declined after lower backlog and improved fraud prevention.

The US GDP growth rate and jobless claims numbers will also be relased tomorrow. The former has a forecast of QoQ 30% increase, which is very optimistic considering the US economy is negatively impacted by the increasing COVID cases. The latter forecast is lower than previous release, most the drop can be attributed to California, where the claims declined after lower backlog and improved fraud prevention.

Part 4. Technical Analysis

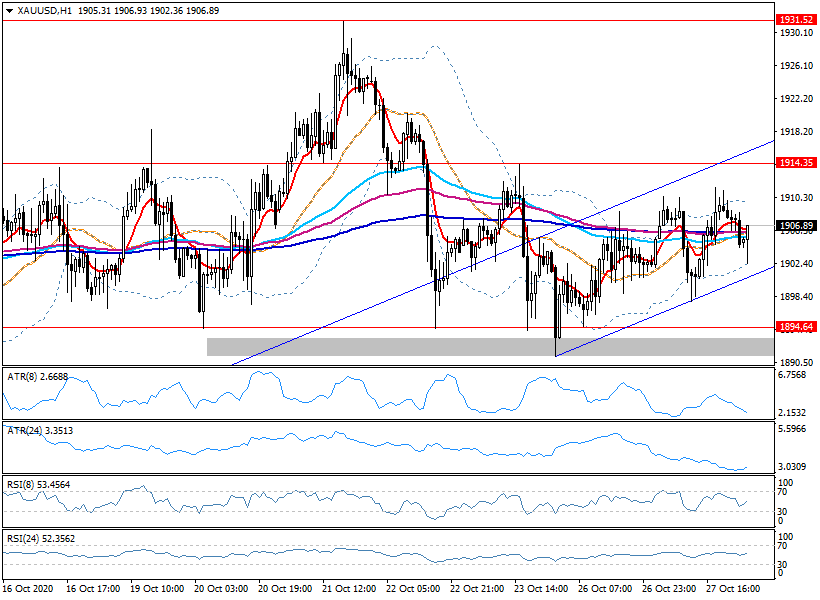

XAUUSD

The gold market is also searching for direction before the US election, and there is no clear trend for the past week, and our 5MA system is tangling together on the daily chart, suggesting a wide range consolidation. In terms of intraday, XAU was slowly rising for the past two days with higher highs and higher lows, if such movement is retraceable, XAU may continue to rise slowly, with resistance at nearest high 1914 before the rise two days ago.

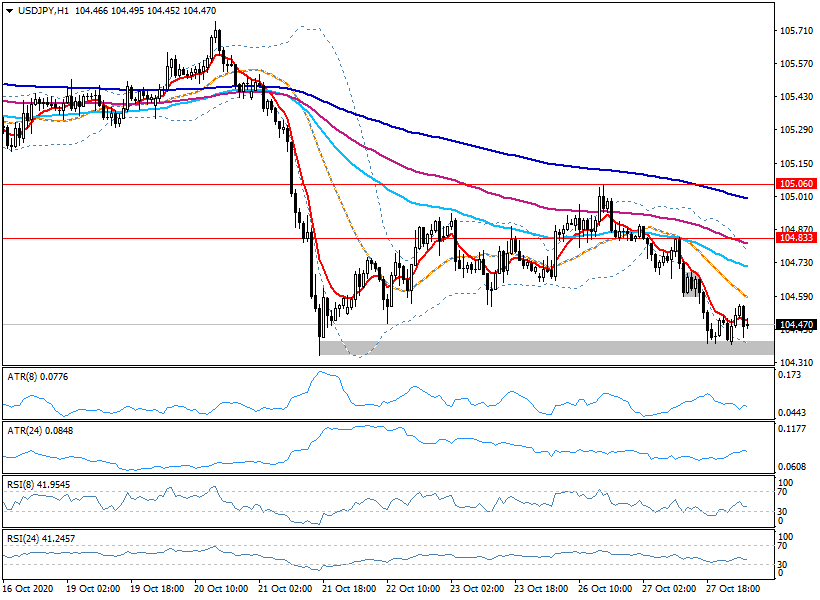

USDJPY

JPY was also consolidating for the past week between 105-104.3. In terms of intraday, USD falled against JPY yesterday, whilst the previous resistant level held effective. As it is now showing signs of rebound, the 5MA system on the daily chart is forming a bearish pattern, therefore the rebound may find difficulty retracing the previous high. The candlesticks for the past few hours are protraying classic reversal pattern, with three bullish candlesticks followed by a strong bearish candlestick. It is recommended to keep a close eye on whether the previous resistance is still effective if a reversal does happen, and search for patterns that hint directions.

English (Australia)

English (Australia) 中文 (中国)

中文 (中国)